vermont income tax brackets

Tax Rates and Charts. For an in-depth comparison try using our federal and state income tax calculator.

States That Won T Tax Your Retirement Distributions Retirement Money Retirement Retirement Income

We last updated Vermont Income Tax Instructions in February 2022 from the Vermont Department of Taxes.

. 2017-2018 Income Tax Withholding Instructions Tables and Charts. 2019 Income Tax Withholding Instructions Tables and Charts. Vermont Tax Brackets for Tax Year 2020.

The more you earn the higher the percentage youll pay in income tax on your top dollars. 2021 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Below we have highlighted a number of tax rates ranks and measures detailing Vermonts income tax business tax sales tax and property tax systems.

This tool compares the tax brackets for single individuals in each state. There are four tax brackets that vary based on income level and filing status. Click the tabs below to explore.

Vermonts tax rates are among the highest in the country. Charge a progressive tax on all income based on tax brackets. The Vermont State Tax Tables below are a snapshot of the tax rates and thresholds in Vermont they are not an exhaustive list of all tax laws rates and legislation for the full list of tax rates laws and allowances please see the Vermont Department of Revenue website.

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute. By any measure the tax code is huge. 2018 VT Rate Schedules.

To calculate taxable income in Vermont begin with federal taxable income which can be located on your Federal Form 1040. 2019 VT Tax Tables. Oo Taxpayers with income of more than 79300 but less than or equal to 84600 shall reduce the amount of tax due by deducting an additional amount equal to 40 for income exceeding 83600 but less than or equal to 84600 plus an additional 100 for every 1000 by which income exceeds 79300 but remains less than or equal to 83600.

Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets. As you can see your Vermont income is taxed at different rates within the given tax brackets. And 4 may not apply an.

31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due dateIf you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face late tax payment. Vermont Income Taxes. 1 And each Monday the Internal Revenue Service publishes a 20- to 50-page bulletin about various aspects of the tax code.

Any income over 204000 and 248350 for SingleMarried Filing Jointly would be taxes at the rate of 875. Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax bracket to 875 the highest Vermont tax bracket. For more information about the income tax in these states visit the Vermont and Connecticut income tax pages.

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. Vermont State Income Tax Return forms for Tax Year 2021 Jan. Vermont Income Tax Vt State Tax Calculator Community Tax.

Read the Vermont income tax tables for Married Filing Jointly filers published inside the Form IN-111 Instructions booklet for more information. 2 Fortunately its not necessary to wade through these massive libraries to get a basic understanding of how income taxes work. 3 may not set a minimum income tax rate less than 225 of an individuals Maryland taxable income.

State Corporate Income Tax Rates And Brackets Tax Foundation. Understanding Marginal Income Tax Brackets. Single Filers Vermont Taxable Income Rate 0 - 40350 335 40350 - 97800 660 97800 - 204000 760 Jan 1 2020.

This form is for income earned in. Rates range from 335 to 875. 1 must set by ordinance or resolution the income brackets that apply to each income tax rate.

2021 Income Tax Withholding Instructions Tables and Charts - copy. The table below shows rates and brackets for the four main filing statuses in Vermont. A State-by-State Comparison of Income Tax Rates.

2020 Income Tax Withholding Instructions Tables and Charts. A county that imposes the tax on a bracket basis. States With Highest And Lowest Sales Tax Rates.

2017 VT Rate Schedules. List Of States By Income Tax Rate See All 50 Of Them With Interactive Map. Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021.

2017 VT Tax Tables. 2 may set income brackets that differ from the income brackets to which the state income tax applies. It is almost 75000 pages long with footnotes.

For income taxes in all fifty states see the income tax by state. File Now with TurboTax. Each marginal rate only applies to earnings within the applicable marginal tax bracket.

Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. The states top tax rate is 875 but it only applies to single filers making more than 206950 and joint filers. The remaining states and Washington DC.

Individual Taxes Business Taxes Sales Taxes Property Taxes. For example Californias top rate is 133 but youll only pay this on income over 1 million. Detailed Vermont state income tax rates and brackets are available on this page.

2018 VT Tax Tables.

States With The Highest And Lowest Property Taxes Property Tax High Low States

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

File Top Marginal State Income Tax Rate Svg Wikipedia

Which States Have The Lowest Property Taxes Property Tax Usa Facts History Lessons

Top Personal Income Tax Pit Rates In The 50 States In 2004 And 2005 Download Table

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

States With The Lowest Corporate Income Tax Rates Infographic Infographic History Geography Columbian Exchange

Beware Of Text Messages That Request Personal Information If You Do Not Know Who Is Making The Request Forward It To Spam Text Messages Messages New Tricks

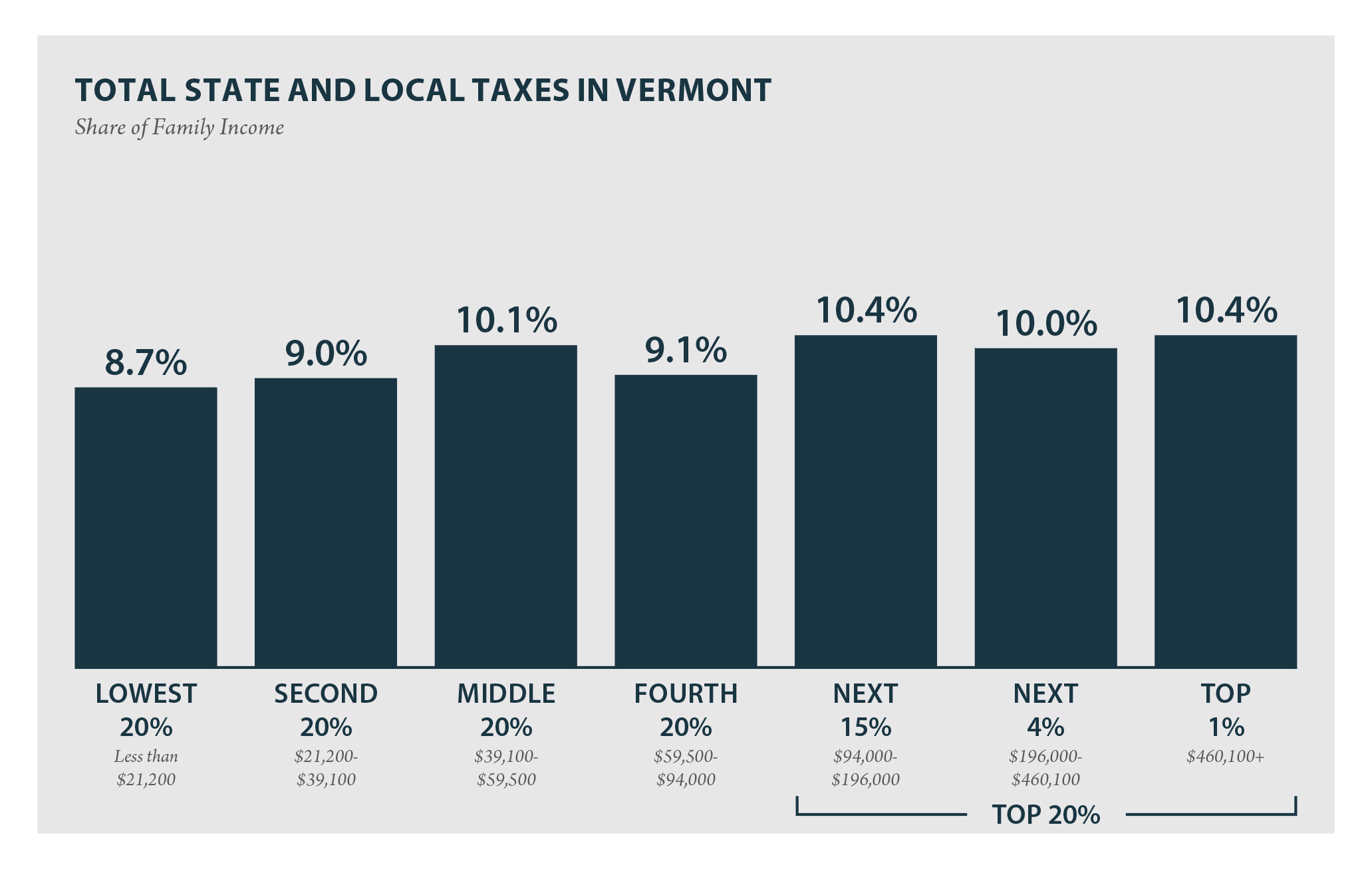

Vermont Who Pays 6th Edition Itep

Buying Cheaper Than Renting But Some Mortgages Make It A Closer Call Trulia S Blog Rent Vs Buy Home Ownership Home Buying

2022 State Income Tax Rankings Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)